We're sure you've heard of “NFTs” blowing up on the Internet.

If you don’t know what they are, NFTs, or "non fungible tokens" are authenticated, one of a kind digital assets that have sold for as high as millions of dollars, giving the buyer claim to the "original" version of a computer file.

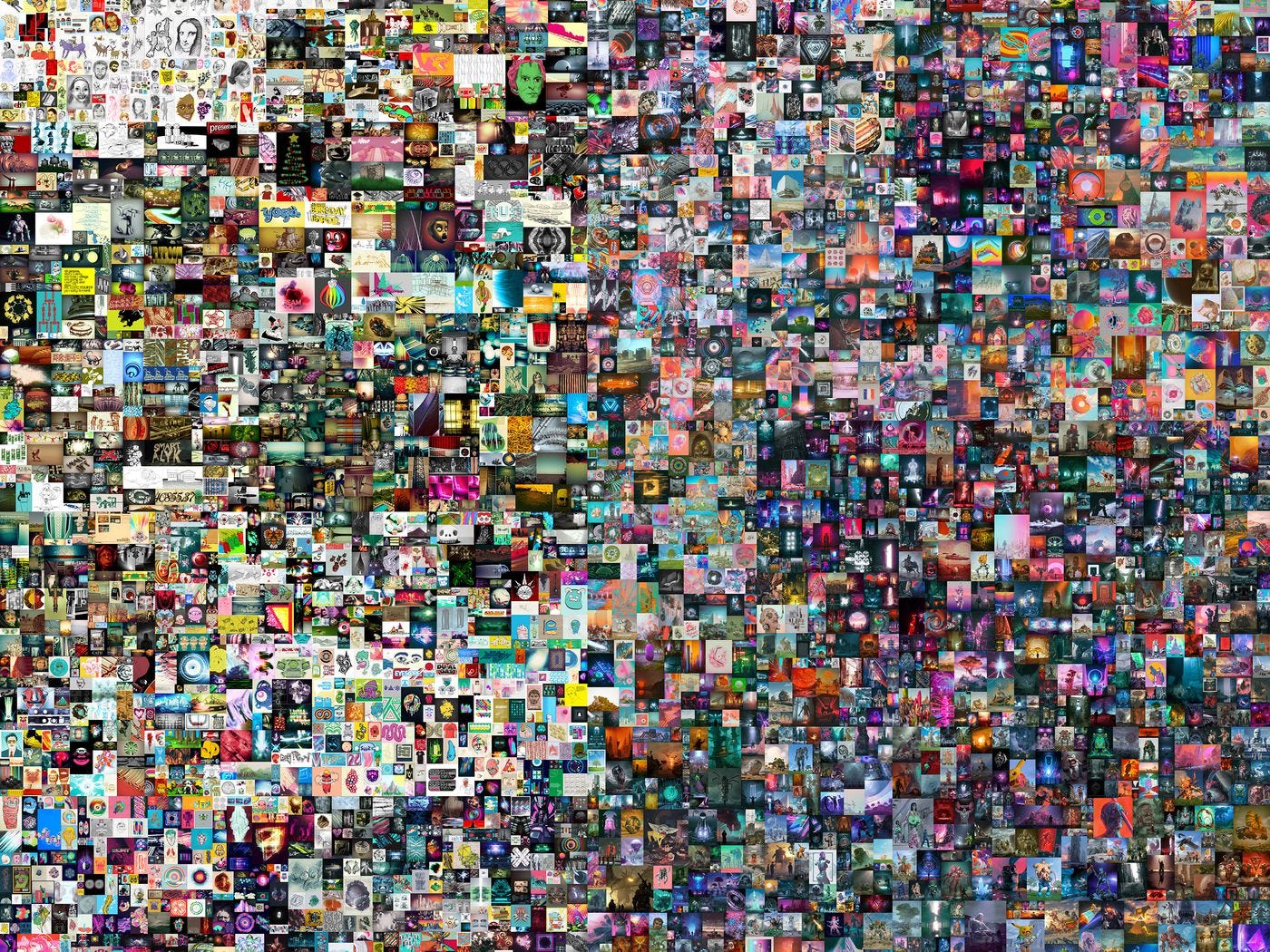

They are all the rage right now — Mike Winkelmann, better known as "Beeple", sold his piece "Everydays" for $69M; Justin Blau (3LAU), an EDM artist earned $17M this past month; Grimes, a dream pop artist, producer, and director earned $6M off the NFTs she made. Even brands like Charmin are selling toilet paper themed crypto art.

Since the Internet's creation, digital artists didn't have a safe way to sell their art online without it getting stolen. NFTs revolutionized the way you can own digital images, allowing artists to monetize their digital pieces.

It's a new age of expression.

At a Glance

After years of content creators generating visits and engagement on their social media platforms while getting almost nothing in return, artists are finally getting their big break, transforming how the world values art.

Art makes people feel alive and connected, two things that have been exemplified as necessary and hard to find feelings during the pandemic. The $64 billion global art market has drastically changed with NFTs, as new online “metaverses” grow to foster and support new artists.

Yet, because NFTs are based on blockchain, the lack of transparency behind the environmental impact and other initial obstacles behind fraud and mining issues brings to question whether NFTs are more than just the next hot phase.

The Rise of NFTs

NFTs are a form of CryptoArt, a recent movement to help artists monetize their artwork online.

Originally, the traditional physical art market has a large barrier of entry, dominated by wealthy collectors and auction houses. On the other hand, the Internet has problems of its own, with the lack of a real platform to sell their own work and the difficulty of protecting their own work from being stolen.

As the internet grew, so did the creator economy. What originally existed for artists, like Instagram and Twitter, eventually blossomed into platforms like TikTok, Twitch, and OnlyFans. These new niche creator perspectives made it even easier for individual people to easily make and share their voice through content, while also monetizing their work.

NFTs were an easy by-product to follow. NFT marketplaces combine the traditional role of auction houses with social Internet platforms in a few different ways:

Marketplaces created digital editorial galleries, displaying an array of digital artwork in digital metaverses.

Artists can more easily earn revenue. Marketplaces have increased the profit from primary sales (50% → 85% on SuperRare), or first sales of an artwork, and added profit to secondary sales (0% → 10%), artwork sold anytime after the first.

Investors in crypto were the first to join these platforms as collectors, adding to the scarcity of work normally seen in physical art.

Platforms also track the value of artwork over time, eliminating geographical and analytical barriers, building on top of the creator economy.

How NFTs are Made

To keep it simple, NFTs are authenticated computer files that have proof of ownership. They exist on Ethereum, or ETH, blockchain (a ledger that is tamper resistant), similar to Bitcoin. ETH is built on a system called "Proof of Work'' (PoW), a security system built for cryptocurrencies because there is no third party that oversees transactions.

Here's what it takes to "mint" an NFT that is unique, scarce, and indivisible:

Artists sign up on an online marketplace (OpenSea, NiftyGateway, Foundation, SuperRare, and Zora) to name a few.

They then upload and validate their information on the ETH blockchain, while paying (ironically named) a gas fee that costs between $40-200 depending on demand and how many people are uploading and validating at the same time.

Next, artists receive an asset that has unique and traceable metadata which can now be sold and owned.

Finally, they can auction their piece off.

Some additional things to note about ETH blockchain:

Because ETH is a decentralized system, it needs to ensure that everyone agrees on the order of transactions. To keep records secure the system forces computers (called miners) to solve complex puzzles, which let them add a "block" of verified transactions to the blockchain. This helps secure the network from attacks.

The miner gets tokens or transaction fees as a reward for solving the puzzle.

Environmental Cost

On the surface, NFTs sound incredible. Providing artists the ability to exist and monetize in a digital world has been incredibly difficult to do and NFTs seemed to be the solution. However, NFTs transact through blockchain mining, which has been historically documented to be a huge energy monster for Bitcoin. So, what did that mean for NFTs?

Along with the initial personal findings by Joanie Lemercier, the short essays and website created by Memo Akten begin to shed the incredibly energy-draining process NFTs create. We urge you to check out these resources for yourself for many interesting findings, but we’ll sum up the key learnings.

A single average ETH transaction consumes around 35 kWh. An average American household consumes around 29 kWh each day.

A single transaction related to NFTs consumes around 82 kWh.

An average NFT consumes around 340 kWh. NFTs require many individual transactions including mining, bidding, cancelling, sales, transfer of ownership, etc. This is the same as flying on a plane for 2 hours or leaving your computer on for 10 months.

Sites can generate large amounts of energy across all NFTs quickly, with one generating 6 GWh.

Regardless of price, all NFTs generate on average the same amount of energy.

Most mining is not primarily powered by renewable energy, including hydro-electric power in China. We’ll talk more later about miners taking advantage of low electricity cost communities and displacing others from using renewable energy.

Note that these findings are based on the PoW blockchain alone, excluding the energy required to produce the artist’s work, storing the work, the computers running the marketplace and other data services.

Human Cost

Along with their environmental cost, NFTs present multiple challenges that impact humans in ways that may not seem obvious:

Scammers are rising along with the NFT hype with artists are seeing their work minted that they didn't mint themselves. The NFT systems currently don’t require individuals to own the copyright to mint something currently.

Miners are moving to sparser areas (Plattsburgh, NY or Bonner, Montana) where the land and electricity are cheap. As the miners arrived, the electricity bills for everyone skyrocketed as the miners used up more energy than the city was given. This is not specific to ETH, but blockchain miners in general.

In these sparse regions, cryptocurrency mining is also causing public health and infrastructure issues, overwhelming local power grids by taking up 70% of the power generated in many regions and causing local fires during heat waves.

NFTs Today

We do believe that NFTs and blockchain technology are a massive first step toward better supporting artists with a better platform to distribute and monetize their artwork while also providing a new place to build content. The pandemic only exacerbated this need, encouraging people to reshape how we communicate.

However, the lack of transparency makes it difficult for us to hold these platforms responsible and reduce the potential damage NFTs cause. These learnings about the environmental and human costs are recent discoveries all made within the past few months, and many artists and community members wanting to get involved don’t know.

This isn’t to say other marketplaces shouldn’t be held accountable as well, but as with every other good we tackle in this newsletter, we want the broader concerns of sustainability and ethical needs to drive change.

Work from folks like Memo Atken and others help to bridge this gap and encourage those involved to work to truly build toward finding sustainable ways in energy production as these innovations take decades to test and deploy (as we know from Moore’s law). And our emissions are only going to keep growing.

Ways to Improve NFTs

Let’s take a look at some of the best ways to make NFTs more sustainable. Some of the best ways to improve NFTs are the mining procedures:

ETH is going through a series of upgrades (Eth2) that will replace mining with staking in a couple of years, which will replace computing power with funds as a security mechanism. This could result in a 99.98% energy reduction.

Memo Atken’s README outlines several different procedures for NFTs:

Lazy minting: Not create an NFT until it’s purchased.

Sidechains: Minted on non-ETH Proof-of-Stake (PoS) blockchains before being moved to ETH.

Bridges: Make multiple blockchain ecosystems compatible with other blockchains.

Switch to non-ETH PoS blockchains: Algorand, Tezos, Polkadot, etc. blockchains support platforms like KodaDot, Viv3, etc. that are more eco-friendly.

Using clean and renewable energy. Some experts have argued that relying on renewable energy isn’t a perfect solution for proof-of-work cryptocurrencies either. If mining for tokens continues to be extremely energy intensive, it will eat up renewable energy that could otherwise go towards things like heating or lighting homes.

What You Can Do

So for all of you still interested in purchasing or creating NFTs, here are some things you can do:

There are eco friendly and more sustainable options available to buy and sell NFTs (they use different blockchains): KodaDot, Viv3, hic et nunc, Kalamint, SIGN Art, Atomic.

Investigate other aspects of your life that use a lot of energy (apparently banks have a large environmental impact??)

Learn more about the ecological impact of blockchain through the links in this article!

Friends help other friends be sustainable — share with others what you learned about NFTs by linking out our article to others 👾.

Questions or comments on this piece? Suggestions on what we should cover next? Send us a note.